What are Self-Funded Health Plans?

Self-funded (or self-insured) health plans are employer-sponsored plans where the organization assumes financial responsibility for providing healthcare benefits to employees. Instead of paying fixed premiums to an insurance company, employers pay for actual medical claims as they occur, plus administrative costs.

Key Benefits

- Potential cost savings of 10-25%

- Greater plan design flexibility

- Access to detailed claims data

- No state insurance premium taxes

- Cash flow advantages

Key Considerations

- Financial risk exposure

- Administrative complexity

- ERISA/CAA fiduciary responsibilities

- Need for stop-loss insurance

- Claims volatility management

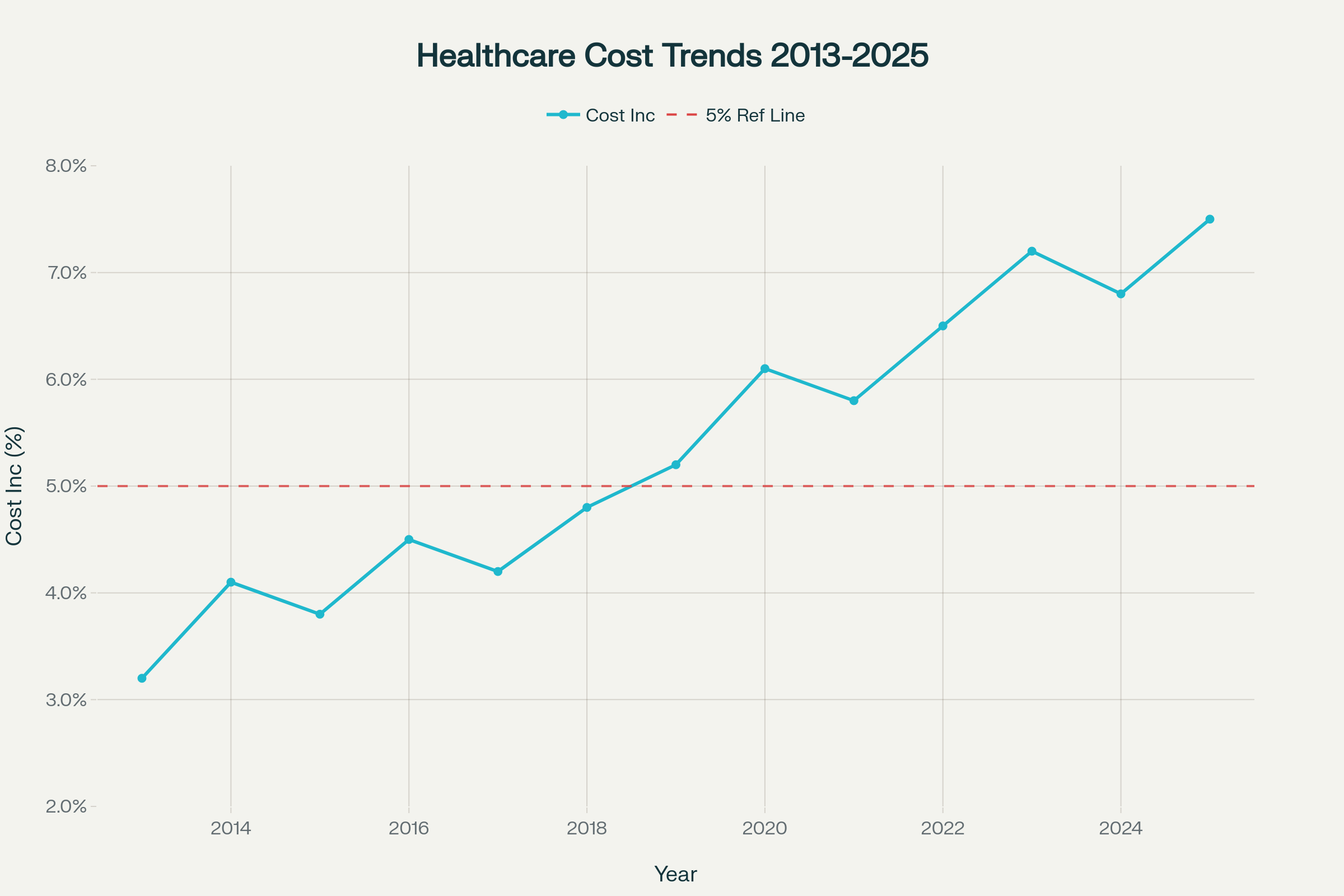

Healthcare Cost Trends Analysis

Healthcare costs have been accelerating, with three consecutive years above 5% increases

Primary Cost Drivers

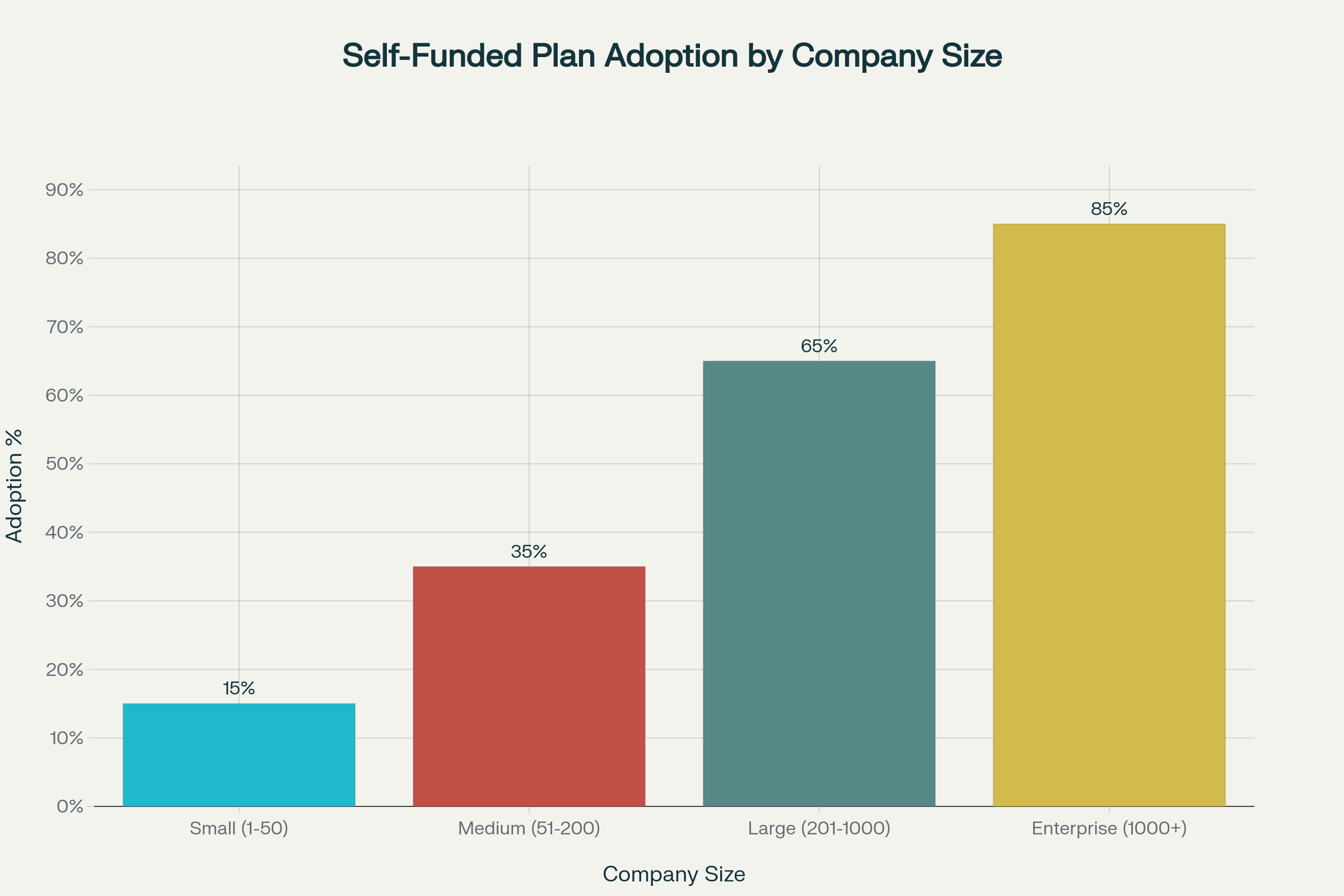

Self-Funded Plan Adoption Analysis

Adoption rates vary significantly by company size and industry

Industry Performance Comparison

| Industry | Success Rate | Avg Savings | Employee Satisfaction |

|---|

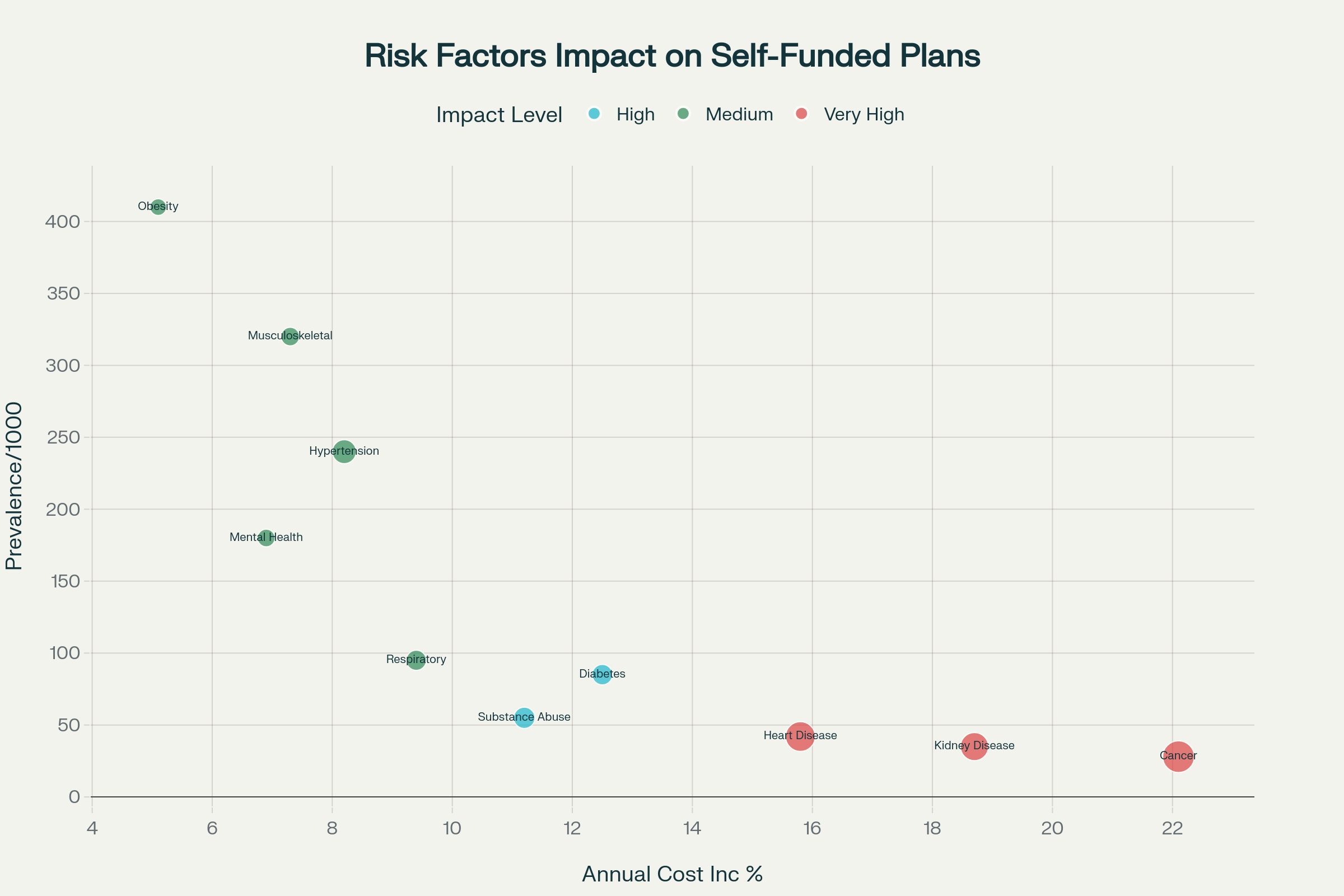

Risk Assessment & Management

Understanding and mitigating financial risks in self-funded plans

Stop-Loss Insurance Thresholds

| Company Size | Specific Stop-Loss | Aggregate Attachment |

|---|

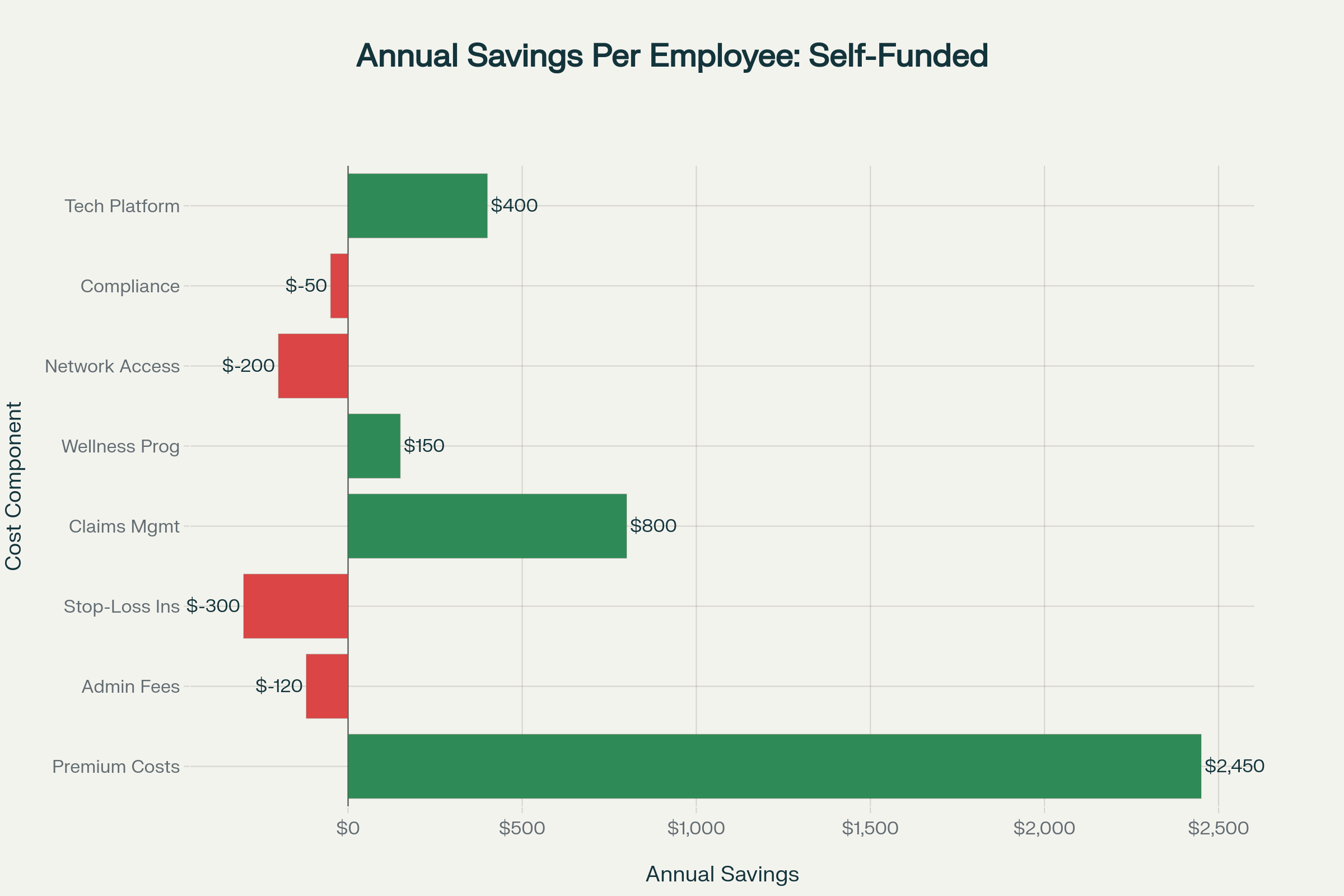

Self-Funded Savings Calculator

Estimate potential cost savings for your organization

Your Organization Details

Projected Savings

Enter your organization details to see potential savings

Implementation Guide

Step-by-step roadmap to self-funded health plan implementation

Compliance Requirements

ERISA/CAA Compliance

- Plan documents and SPD

- Fiduciary training

- Claims procedures

- Appeals process

HIPAA Requirements

- Privacy policies

- Security safeguards

- Business associate agreements

- Breach notification procedures

ACA Compliance

- Essential health benefits

- Preventive care coverage

- Mental health parity

- Reporting requirements

Utilization Patterns Analysis

Understanding healthcare utilization by demographics and risk factors

Healthcare Costs by Age Group

| Age Group | Avg Annual Claims | Chronic Conditions | Preventive Care Use | High-Cost Risk |

|---|

Key Insights

Age Distribution Impact

Organizations with older workforce (45+) see 2-3x higher claims costs but also higher preventive care utilization.

Chronic Disease Management

62% of employees aged 56-65 have chronic conditions, making population health management critical for cost control.

Preventive Care ROI

Higher preventive care utilization correlates with better long-term cost management and employee outcomes.